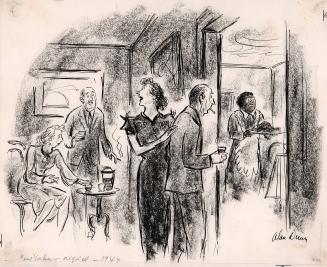

Skip to main content

"Now look - International has a net quick of $15 per share. Its market price is $10, book is $36.65. Our net quick is $8; our book is$22, and at market we are selling for $25. So to start with we offer them one share of ours for two of theirs. That's five bucks premium. Can they turn it down? So they turn it down. Then we say, O.K., we'll buy the assets. We'll give you $1 million for your plant, which stands at $3,900,000 net. That wipes out all the water, gives them a fine tax carry-back. Then we give them 80 per cent of net inventory and accounts receivable - that's another $4 million. Another nice tax loss for them. So we pay 'em $5 million. There's nothing complicated about this except - say, where do we get the turn-around money"

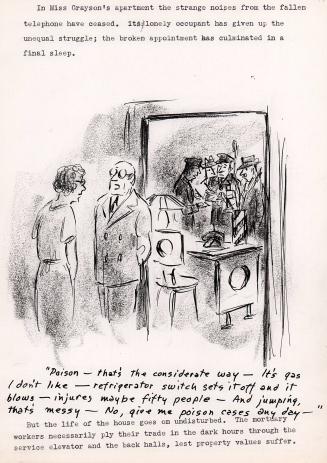

Artist

Alan Dunn

(American, 1900 - 1974)

Date1954

ClassificationsCartoon

Mediumcrayon ink

DimensionsObject: 6 1/8 × 8 3/8 in. (15.5 × 21.3 cm)

Sheet: 6 1/8 × 8 3/8 in. (15.5 × 21.3 cm)

Credit LineMary Petty and Alan Dunn Bequest

Object number1979.2190